Employers & Benefit Brokers Evaluating ACA 6056 Reporting Software

If you are a large employer or employee benefit broker, chances are you have spent a lot of time trying to determine the best ACA 6056 reporting and compliance solution for your clients. We do not sell software – but rather full service reporting. However, we have researched almost a dozen different ACA employer reporting and compliance vendors and we thought we would pass along what we learned.

Beginning Questions To Ask Yourself

As an employer or benefit broker, this is how the ACA reporting question breaks down for you.

1). Some employers will have their online enrollment (benefits administration) and payroll with the same vendor. In those cases, as long as the client is willing to pay for it, it will likely make sense to just perform the required ACA reporting of IRS forms 1094 and 1095 with that vendor.

2). Some employers will not have an outside benefits administration or payroll vendor. They do everything in-house. For these employers, there is going to be a lot of ACA work to be done and obviously you will need a stand alone solution.

3). Finally, you have some employers who have payroll and benefits administration with different vendors. This would include the scenario where one of these functions is performed in house. In these cases you will either need to consolidate both payroll and benefit plan elections with one vendor, or you will need a stand alone solution.

Basic Conclusion: If you are an employee benefit broker with various types of employer clients, we don’t see a scenario where you can get away with not having a stand alone ACA reporting solution to help your clients meet their ACA Reporting Requirements.

What do you need to know in evaluating ACA stand alone software vendors? Things to keep in mind as an employee benefit broker if you want to do this on your own.

Employee Benefit Brokers, Ask Yourself These ACA Reporting and Compliance Questions

1). Security? What if all of the social security numbers of your client’s employees was stolen? Can you imagine the fall out? Many of the systems we reviewed were severely lacking in terms of security. What level of encryption is being used for the data?

2). Branded to your company? Many different ACA reporting vendors offer the ability to brand a portal to your company that your employer clients will be able to login from.

3). Is the system mainly a benefits administration system? The differences in these systems can be extreme – from very low level to incredibly high level. Will this add additional costs for the ACA reporting module? Also with many benefits administration systems, there are additional charges for EDI (electronic data interface – where election data is sent to insurance carriers). Will additional fees apply with this new ACA reporting?

4). Is the ACA reporting solution even built yet? Many of the ACA reporting module demo’s we sat in on were from vendors who do not even have the software built yet.

5). How long will your data be stored? The IRS has said that audits will begin starting in about 18 from months from the filing date, and that can last for 7 years total. If you do not have a methodology to get back to your data at the time of inquiry, you are stuck.

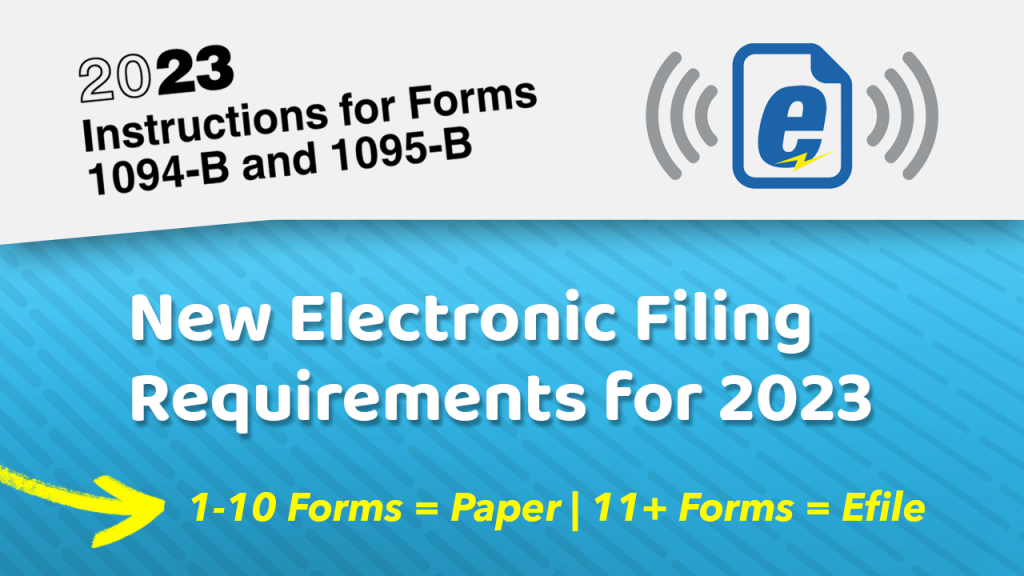

6). Is your vendor set up to file with the IRS? Did they just lie to you and say yes to that question? As of the writing of this blog, no one is set up to file with the IRS electronically (efile) for forms 1094 and 1095. The IRS has literally just issued the guidelines to begin getting started with this.

7). Variable hour tracking? Do you need variable hour tracking to determine eligibility? For many employers a simple spreadsheet will do the trick. Many vendors have quite robust capabilities in this area, and for some employers this will definitely make sense.

8). The ‘Gotcha Moment’. This comes at the end of a great presentation where they tell you there is an additional $3 to $5 per employee to file the forms with the IRS. Generally this will make the costs of this solution not competitive.

9). ROBUST ACA LOGIC. We cannot tell you how important this is! If you have spent as much time looking at these forms as we have (especially in terms of form 1095c lines 14, 15 and 16) you will know that performing this reporting is MUCH MORE than just uploading a spreadsheet. The codes for these lines are based upon logic. Most systems do not have this logic built into their system, but rather it will be up to you as an employer or benefit broker to figure this out. For most employee benefit agencies, you can count on this little ‘bug’ shutting down your operations in January.

What if you decide to just file them incorrectly? When your largest client has 100 employees bring them letters from the IRS, you will then realized this was a very bad idea.

Also, without robust logic built into the system there will be no accommodation for situations such as someone terminating in November/December and then electing COBRA in January. The codes for these situations are different.

10). Are forms stored for future access and corrections? Bottom line – there is going to be issues with the reporting from time to time. Do you have the ability to go back into the system and create a new/corrected 1094 or 1095 form on behalf of the employee? Many systems that rely solely on a census upload would require you to basically start over in order to make this one fix. OR, your staff can just manually create one in .pdf which will take a lot of time.

11). Do you have to pay for the whole system up front, or are there monthly options? Do you need to commit to multiple years with the software vendor? Do you have to pay onging for the solution or only once? Are there implementation costs? Are there separate fees for the IRS form file reporting and all other functions in the system?

12). Can the employee elections be uploaded via census, or do you need to type it all in?

13). Will they have adequate customer support between January 1st and January 31st so that you can KNOW you will be able to get this all done?

14). Do you want to just let the payroll vendor do this for your client? Do you really want to recommend your client that they should have another function performed by someone who wants nothing more than to take your business away from you?

. . . OK, that is enough! We hope you find this helpful. In the case that you would like someone to be fully hands on and provide great service to get all of this reporting done, we will be here to help!