One of the most common questions we are receiving is regarding the impact to employees filing their own personal taxes now that there has been an extension of time allowing employers and organizations until the end of March 2016 to supply forms 1095-B and 1095-C to their employees. The concern rises when employers consider how employees can complete their normal tax filings without being provided the forms showing their health coverage for the year.

The IRS recently released some guidance to assist us with understanding this topic. In their guidance they have said, “Due to these [ACA reporting] extensions, some individual taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their 2015 tax return. While the information on these forms may assist in preparing a return, they are not required. Like last year, taxpayers can prepare and file their returns using other information about their health insurance. Individuals do not have to wait for their Form 1095-B or 1095-C in order to file.

The IRS has not extended the due dates for Health Insurance Marketplaces to issue Form 1095-A. Individuals who enrolled for coverage through the Marketplace should receive Form 1095-A by February 1, 2016 and should wait to file their returns until the receive their Form 1095-A.”

The IRS has also said that individuals can rely on information from their employer or provider without having to amend their return later. https://www.irs.gov/Tax-Professionals/ACA-Information-Center-for-Tax-Professionals

So what is the overall actual impact?

Since the forms 1095-B and 1095-C are informational returns, much like 1099’s and W-2’s, the extended filing deadline for employers will not affect companies income tax returns. Also, it would seem to reason that individuals will not have to file amended returns if they have wrong (or no) information from their employers due to the extensions. Likely, the IRS will punt on the individual mandate penalties for this year in some cases.

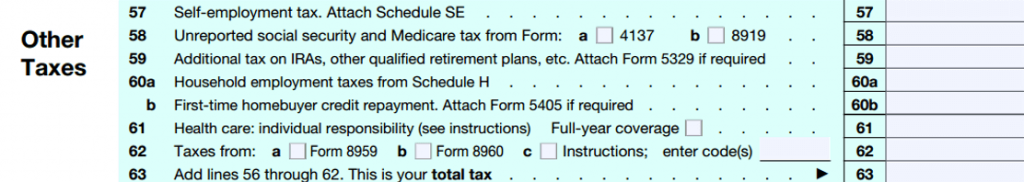

Specifically, on the form 1040 of individuals, there is a line 61 & 62 (shown below) and they will need to complete as part of filing their taxes.