A LITTLE BIT OF CONTEXT

Here we are, 2018 and staring down the barrel of another upcoming election. This time will it be the Democrats who takeover control of congress? Will the Republicans maintain their stronghold and gain seats? How will the outcome of this election shape the landscape for ACA reporting going forward? The answer might not be what you think.

We’ve watched for years now as Republicans have fought to fulfill their promise of dismantling the Affordable Care act and along with it, the unpopular Employer Mandate. This mandate has required employers with 50 or more full time employees to offer certain healthcare coverage then report their offers of coverage via informational returns (1094/1095Cs) that are then supplied to employees. These reports are ultimately filed with the IRS. Failure to comply with this law can result in millions of dollars’ worth of penalties for the employer. So how can the 2018 midterm affect this?

The broad consensus that we are hearing at Sky Insurance Tech is that if Republicans gain seats and Democrats lose seats, the Employer Mandate will go away and so will the need to report coverage.

To that notion we say, “HOLD YOUR HORSES”.

This common misconception comes from the assumption that ACA Reporting is tied directly to the Employer Mandate. If the Employer Mandate goes away, so does the need to report. That would be a risky assumption. So, I will do my best to explain in the paragraphs that follow, why that thought process is totally incorrect.

THE REPORTING IS ALL ABOUT THE SUBSIDY ELIGIBILITY

First things first, what are we talking about with ACA Reporting? Why do employers have to report their offers of coverage? To be compliant with the ACA laws of course! Right, however lets really think about why this is part of the law. This is part of the law because of Subsidized health coverage.

That’s right, the reason reporting exists is because healthcare subsidies exist, and we must determine who is eligible for a subsidy and who is not. An Employers offer of affordable coverage greatly affects an individual’s subsidy eligibility. Universally granting subsidies would be catastrophic for the US budget, so we must determine who needs this assistance.

So, there’s your short answer. No matter what happens to the ACA law, if there are subsidies there will be reporting.

Here is where the rebuttal comes in, “well what if we get rid of the subsidies altogether”? Really? Do you think that is a possibility at this point? I think now is a good time to take a closer look at the numbers, then we can formulate a more educated opinion.

ALL ABOUT THE SUBSIDIES

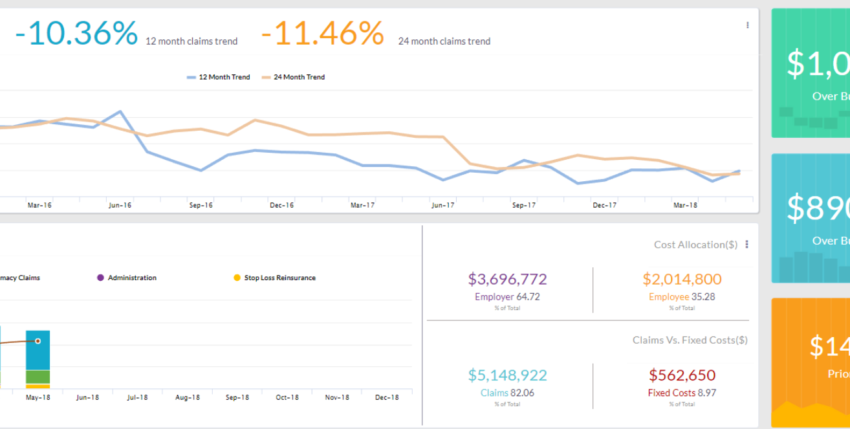

Based on a recent report released by the Congressional Budget Office (CBO), in an average month in 2018, about 244 million people under the age of 65 will have health insurance, and around 29 million people will not. By the year 2028 it is projected that the 29 million number will grow to around 35 million. Currently net federal subsidies for “Insured” people in 2018 total around $685 Billion. These subsidies are expected to grow to 1.2 Trillion in the year 2028. These subsidies are being used to help pay for: Medicaid, The Children’s Health Insurance Program, Medicare, and coverage obtained through the ACA Marketplace. So, at this point we must ask these questions: Can we really get rid of these subsidies? If we attempt such a thing what would be the outcome? How would this affect the American people?

WHAT DO SUBSIDIES LOOK LIKE GOING FORWARD?

According to the CBO, an average month in the year 2018 will look about like this.

- 158 million people will be enrolled in Employment based coverage.

- 12 million people will be eligible for Medicaid due to the expansion brought about by the ACA.

- 49 million will be eligible for Medicaid.

- 6 Million people in the Children’s Health Insurance Program.

- 8 million people on subsidized healthcare coverage from the ACA marketplace.

- 2 million people on unsubsidized coverage from the marketplace.

- 8 million on Medicare.

- 10 million on other coverage.

- 29 million uninsured.

Additionally, health insurance premiums are expected to increase by about 15 percent on average between 2018 and 2019. Then they are expected to increase at a rate of around 7 percent a year between 2019 and 2028.

So where will the money come from to cover all this healthcare? Subsidies of course! I think now is a good time to mention something else. Even If the law changes, and we replace the word “subsidy” for let’s say……. the word “tax credit”, we will still be in the exact same situation.

We will have a growing demand for healthcare coverage, and a growing number of people of who cannot afford it. The strain on the US budget is enormous and growing and we must consistently track subsidy eligibly or else risk massive overspending.

There is simply no way to keep up with subsidy eligibility outside of Employer Based Reporting.

HOW DO WE MITIGATE THE COST OF SUBSIDIZED HEALTHCARE?

There is a short answer to this question as well, taxes and penalties.

These taxes and penalties are expected to reduce the total amount of federal subsidies for coverage by about $21 billion in 2018. Most of these will come from penalties associated with the employer mandate. The IRS is currently enacting those penalties and notifying employers through the issuance of letter 226-J.

HOW WOULD REPORTING BE ENFORCED?

In this article we’ve been talking about a scenario in which the Employer Mandate goes away. (A broad assumption that assumes a Republican Majority and the ability to garner the needed votes). So, in this scenario how would any of the reporting be enforced.

The reporting itself has been and will continue to be enforced by the US Code § 6721 and § 6722. Those are as follows:

26 U.S. Code § 6721 – Failure to file correct information returns

26 U.S. Code § 6722 – Failure to furnish correct payee statements

What these laws state, is that there are penalties associated with not filing correct and timely informational returns to the IRS. Additionally, there are further penalties associated with not furnishing those same returns to employees on time.

The existence of these laws does not hinge on the Employer Mandate remaining the law of the land. However, they will exist if subsidies and/or tax credits exist. These will remain enforceable as long as subsidy eligibility is something that needs to be tracked, and due to costs, they must be tracked.

IN CONCLUSION

At this point hopefully, you now understand why it would be incredibly difficult to remove the need for Large Employers to report their offers of health coverage. Additionally, I hope I’ve done a decent job of explaining the struggle surrounding the notion of removing billions of dollars of healthcare coverage for millions of Americans.

Can we totally remove healthcare subsidies? I don’t think we can, but you are free to decide.

Can the US afford to not regulate subsidy eligibility? I don’t think we can do this either.

Would we need to know details of the offers of coverage from employers for Subsidy eligibility? Yes.

Would that require a form of Employer Reporting similar to what we have now? Absolutely

Unfortunately, there is no crystal ball telling us about the future. Only time will tell us the outcome for certain. Based on the evidence thus far I revisit the question. How will the upcoming mid-terms affect the need for Employer based healthcare reporting? My answer, it won’t.